arizona estate tax exemption 2020

What Are The Qualifications. The federal estate tax exemption is 1170 million for 2021 and increases to 1206 million for 2022.

How To Avoid Estate Taxes With A Trust

The federal estate tax exemption is 1170 million for 2021 and increases to 1206 million for 2022.

. As of 2020 the ID legislator approved property tax. Ad Register and Subscribe Now to Work on AZ ADEQ More Fillable Forms. 1158 million per person was 114 million in 2019.

The estate and gift tax exemption is 1158 million per. Arizona offers a standard and itemized deduction for taxpayers. Federal law eliminated the state death tax credit effective January 1 2005.

If the estate is worth less than the exemption amount no tax liability. Therefore Connecticut estate tax is due from a decedents estate if the Connecticut taxable estate is more than 51 million. Residents and nonresidents owning property there can rejoice.

In 2020 it set at 11580000. Ad Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now. The top marginal rate remains 40 percent.

USLegalForms Allows Users to Edit Sign Fill and Share All Type of Documents Online. The Internal Revenue Service announced today in Rev. While there is no Arizona inheritance tax law you may or may not be exempt from an inheritance tax based on the federal law.

The arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Amounts gifted beyond the annual gift exclusions and beyond the lifetime applicable exclusion would be taxed at that rate.

Final regulations user fee for estate tax closing letter td 9957 pdf establishing a new user fee of 67 for persons requesting the issuance of irs letter 627 estate tax closing letter etcl will be effective october 28 2021. The estate and gift tax exemption is 114 million per individual up from 1118. A federal estate tax return can be filed using Form 706.

Because Arizona conforms to the federal law there is. The purpose of the Certificate is to document and establish a basis for state and city tax deductions or exemptions. Ad Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now.

So the increase announced yesterday by the IRS means that if an estate is created ie if a person dies in 2020 there will be no estate tax imposed if the estate is worth less than 1158 million. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. 25100 for married couples.

The Arizona State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Arizona State Tax Calculator. On May 31 2018 Connecticut changed its estate tax law to extend the phase-in of the exemption to 2023 to reflect the increase in the federal exemption to 10 million indexed for inflation in the 2017 Tax Act. The federal inheritance tax exemption changes from time to time.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. 2019-44 the official estate and gift tax limits for 2020. In 2020 the rates ranged from 12 to 16 percent but they now range from 112 to 16 percent.

TPT Exemption Certificate - General. The eligible project is considered to be municipal property for the purposes of article IX section 2 Constitution of Arizona. This exemption rate is subject to change due to inflation.

2020 Estate Gift GST and Trusts Estates Income Tax Rates. Is The Exemption For My House Only. If you are married the two of you can leave up to 2316 million combined without incurring a federal gift.

Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005. Even though there is no Arizona estate tax the federal estate tax may apply to your estate. But that doesnt leave you exempt from a number of other necessary tax filings like the following.

This Certificate is prescribed by the Department of Revenue pursuant to ARS. Arizona State Personal Income Tax Rates and Thresholds in 2022. The exemption is applied to the real estate first then to a mobile home or an automobile.

The 2021 standard deduction is 12550 for single taxpayers or married filing separately. There are no inheritance taxes or estate taxes in Arizona. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

This tax is portable for married couples. The exemption will be phased in as follows. Each association shall pay a nonrefundable annual license fee of ten dollars.

Total assessed valuation in Arizona must not exceed 27498 for the 2020 tax year. Rate of Taxation The current rate of taxation for taxable gifts and bequests is 40 at the Federal level. You must be a resident of Arizona.

With the right legal steps a couple can protect up to 2412 million when both spouses have died. A nonprofit agricultural products association formed pursuant to this article shall be exempt from all franchise or license taxes imposed on its income. Federal Estate Tax.

No US Estate Tax Applied No US Estate Tax Applied No US Estate Tax Applied. It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale. Generally a person dying between Jan.

License and other fees. The Internal Revenue Service announced today the official estate and gift tax limits for 2020. Arizona also allows exemptions for the following.

31 2020 may be subject to an estate tax with an applicable exclusion amount of 11580000 increased from 114 million in 2019. All estates in the United States that are worth more than 549 million as of 2017 are required to pay an estate tax. Up until 2008 transfer taxes were charged in Arizona and were often paid by the home seller.

Even though Arizona does not have its own estate tax the federal government still imposes its own tax. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. That means you can leave 1158 million to heirs and pay no federal gift or estate tax.

This amount is indexed and changes each year. Every corporation doing business pursuant to this article is declared to be a nonprofit and benevolent institution and to be exempt from state county district municipal and school taxes including the taxes prescribed by this title and excepting only the fees prescribed by section 20-167 and taxes on real and tangible personal property located. The current federal estate tax is currently around 40.

And thanks to estate tax portability a married couple can now shield double that amount 2316.

Is Your Inheritance Considered Taxable Income H R Block

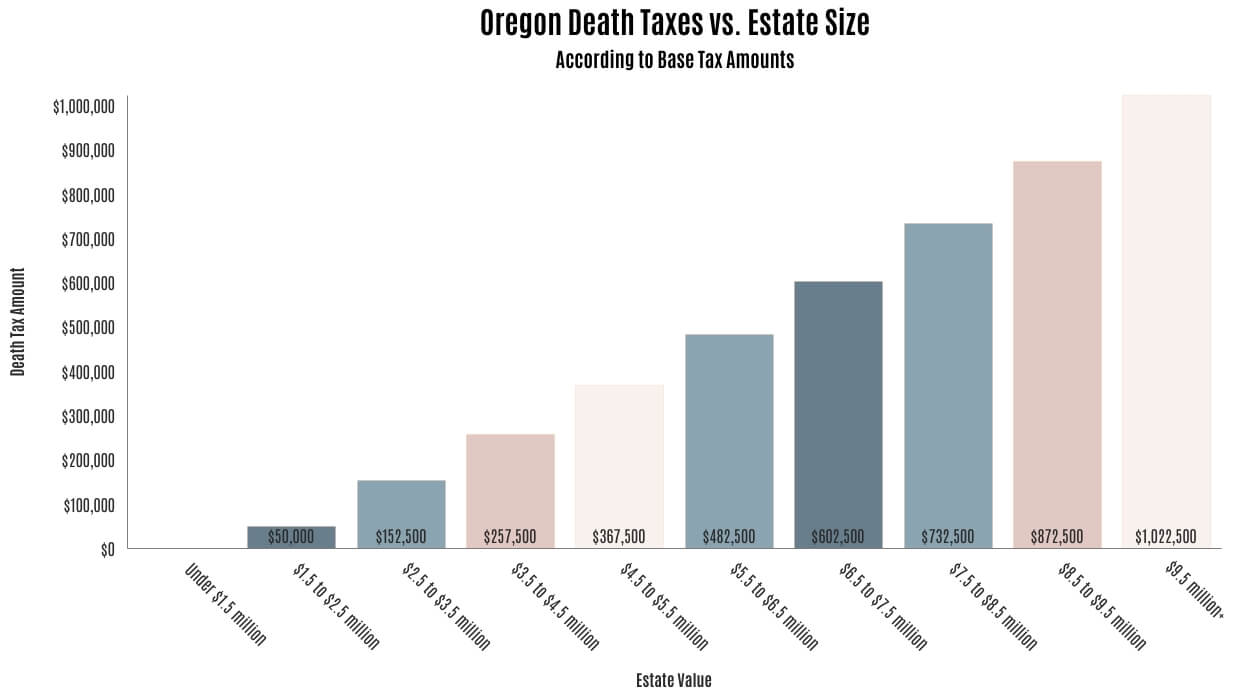

Death Taxes In Central Oregon De Alicante Law Group

State Death Tax Hikes Loom Where Not To Die In 2021

Eight Things You Need To Know About The Death Tax Before You Die

Even With No Estate Tax Some Tax May Be Due On Inheritance Fleming Curti Plc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Arizona Estate Tax Everything You Need To Know Smartasset

Some States Have No Estate Or Inheritance Taxes Legacy Design Strategies An Estate And Business Planning Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Direction Of Estate Taxes Among Top Advisor Concerns

Estate Tax Planning In Arizona Gilbert Az Estate Planning Law Firm

Arizona Estate Tax Everything You Need To Know Smartasset

Arizona Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax And Who Pays It Credit Karma Tax

What Is The Future Of The Estate Tax Exemption Phelps Laclair